A note from the Seattle Metro Chamber President and CEO Rachel Smith regarding today’s payroll tax decision from the Washington State Court of Appeals:

The Chamber brought the payroll tax lawsuit forward because we believe the tax is illegal based on Washington State Supreme Court precedent. We will review the decision and determine our next step in consultation with our members and our attorneys.

The payroll tax is projected to generate more than $277 million in revenue this year, yet despite this and other revenue tools the city has exercised, it has identified a budget gap.

It is our hope, and the expectation of the voters via the latest Index research, that during the upcoming budget process, the city of Seattle will look at all the revenue and resources it has and craft a budget that reflects the priorities of the voters.

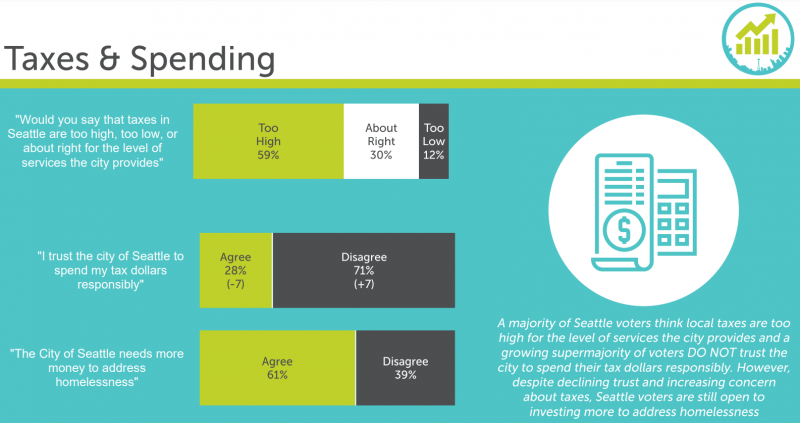

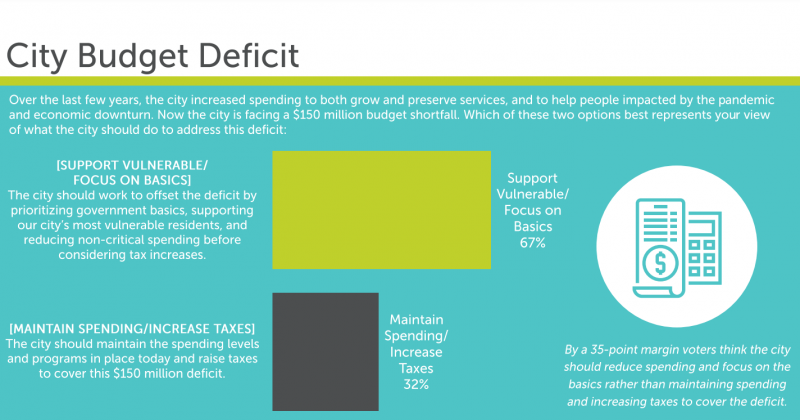

Disappointingly, the city’s first response to the budget conversation, according to local media reports, is to increase taxes – a move that is out of step with voters. According to The Index from March 2022, 67% of Seattle voters said the city should work to offset the deficit by prioritizing government basics, supporting our city’s most vulnerable residents, and reducing non-critical spending before considering tax increases.

Additionally, a majority of voters say taxes are too high in Seattle. Seventy-one percent do not trust the city to spend tax dollars wisely. Voter trust is undermined when the government seeks additional resources but does not come with visible results that improve our quality of life. Nearly 60% of voters believe taxes are too high for the level of services the city provides.

Our economic recovery is fragile – for businesses and residents. Our community is feeling unease and uncertainty about our economic environment – rising inflation, steep gas prices, and tanking 401(k) plans. Voters want to see results: addressing homelessness, enhancing public safety, and improving affordability. Real progress is demonstrated in achieving results.